ROBUST GROWTH IN KOREA’S PREMIUM VOD SECTOR, LED BY TVING

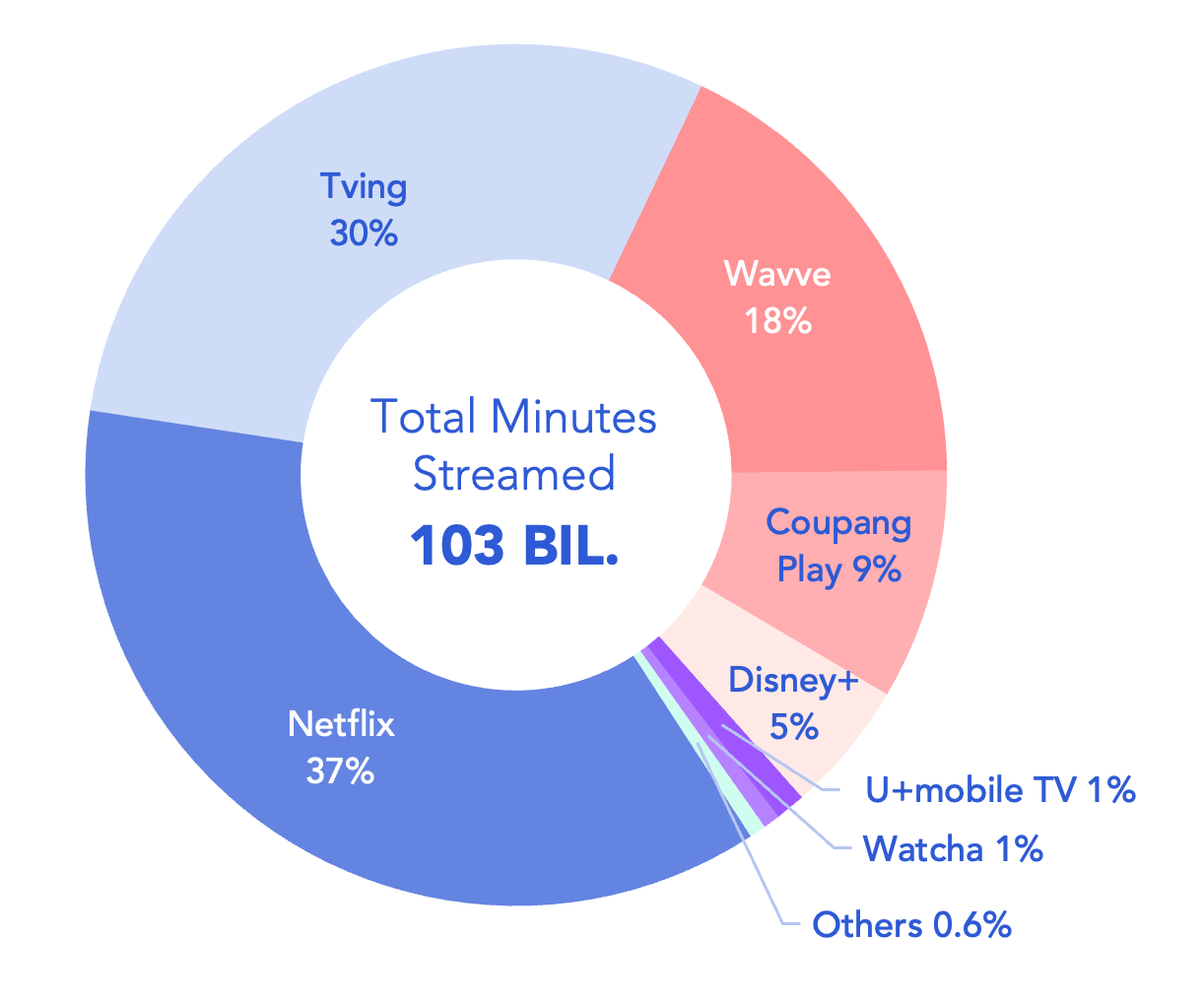

August 13, 2024 2:27 pmThe premium video-on-demand (VOD) landscape in South Korea grew subscribers, revenues and engagement at robust levels in 1H 2024 according to analysis conducted by ampd, the digital measurement platform owned and operated by Media Partners Asia (MPA). The Korean SVOD market added 705,000 net new subscribers in 1H to total 20.8 mil. by end June 2024 while premium VOD revenues, including subscription and advertising, grew 11% year-on-year to US$922 million and viewership grew 5% Y/Y to 103 billion minutes.

Tving led subscriber growth in 1H 2024, contributing 34% share of SVOD category net additions to 4.2 mil. total subscribers. Tving’s growth is anchored to popular tvN and JTBC network dramas, variety and originals. The introduction of a new advertising tier helped drive user growth in 1H 2024, with MAUs >11.5 million. Netflix remains the Premium VOD category leader with 43% share of revenue and 37% of viewership. Tving is gaining pace, growing share of premium VOD viewership by 6 points Y/Y to reach 30%, capturing 15% of premium VOD revenues. Beyond premium VOD, viewership across AVOD, SVOD and live streaming platforms on mobile devices totalled 534 bil. minutes in 1H 2024, up 24% Y/Y. YouTube is the overall VOD category leader and continues to gain share, reaching 80% of total VOD viewership in 1H 2024.

Dhivya T, Lead Analyst & Head of Insights at ampd, commented: “Local content captured 77% of Premium VOD category engagement and 75% of customer acquisition in 1H 2024, with key drama and variety hits from Tving , Netflix , Coupang Play and Disney+. An abundance of local drama and variety releases across major VOD platforms drive viewership, with over 200 titles contributing to 80% of Korean content demand in 1H 2024. Tving led hits across scripted and unscripted titles, carrying 10 of the top 15 titles (7 shared across platforms) in 1H 2024. Other key platforms include Netflix with 7 of the top 15 titles. Disney+ originals Coupang Play’s sports and originals also broke through. CJ ENM produced 6 of the top 15 titles in 1H 2024.”

Premium VOD Viewership Share in South Korea (1H 2024)

|

Source: ampd |

About this report

The ampd platform uses a permission-based panel of consumers who consent to the collection of their session based activity. For this report, the platform passively measured real consumption on all android and iOS mobile devices in Korea in 2024 with a sample size of 1,560. The data reported is anonymized and conforms to data privacy legislation in South Korea. AMPD Vision® was used by MPA to provide a granular view of streaming content consumption across key VOD services on mobile devices. Data from ampd and MPA informs key metrics reported in this study. All data is based on ampd’s proprietary weighting and projection techniques to be nationally representative of mobile consumption for individuals aged 15 to 69.

-END-

About ampd

Across 10 markets ampd leverages 60,000 passively measured panel members with two SaaS based products – ampd Vision and ampd Pulse – while providing customized research to our clients across a variety of sectors including Streaming VOD, Content, Advertising, Telecoms and more. Our clients include leading global internet and technology brands, streaming VOD platforms, Hollywood and Asian content studios, advertising agencies, telcos and pay-TV operators. ampd won the Best International Video Media Research Award at the 2023 UK Mediatel Media Research Awards, which recognizes organizations driving innovation in research.

ampd

ampdanalytics.com/

Media Partners Asia

media-partners-asia.com/

Contact

Lavina Bhojwani, Vice President

(lavina@media-partners-asia.com)

Categorised in: Industry News, Member News

This post was written by Media Partners Asia