AVIA: DELIVERING STELLAR CONTRIBUTION ACROSS THE VIDEO ECOSYSTEM

September 7, 2020 1:20 pmAsia Video Industry Association (AVIA) has been at the forefront of the video industry in Asia. Louis Boswell is the Chief Executive Officer of the Asia Video Industry Association. As CEO, his remit is to lead the industry through championing all broad based initiatives that result in a more vibrant and healthy video ecosystem. This includes being at the forefront of industry research, supporting evolving business models, understanding the role of technology, representing the industry in conversations with regulators and other stake holders.

Louis Boswell shares his insights on the role of AVIA and its contributions in an exclusive interview with Satellite & Cable TV Magazine.

Q1. Tell our readers more about AVIA. The vision, role and core philosophy driving AVIA ?

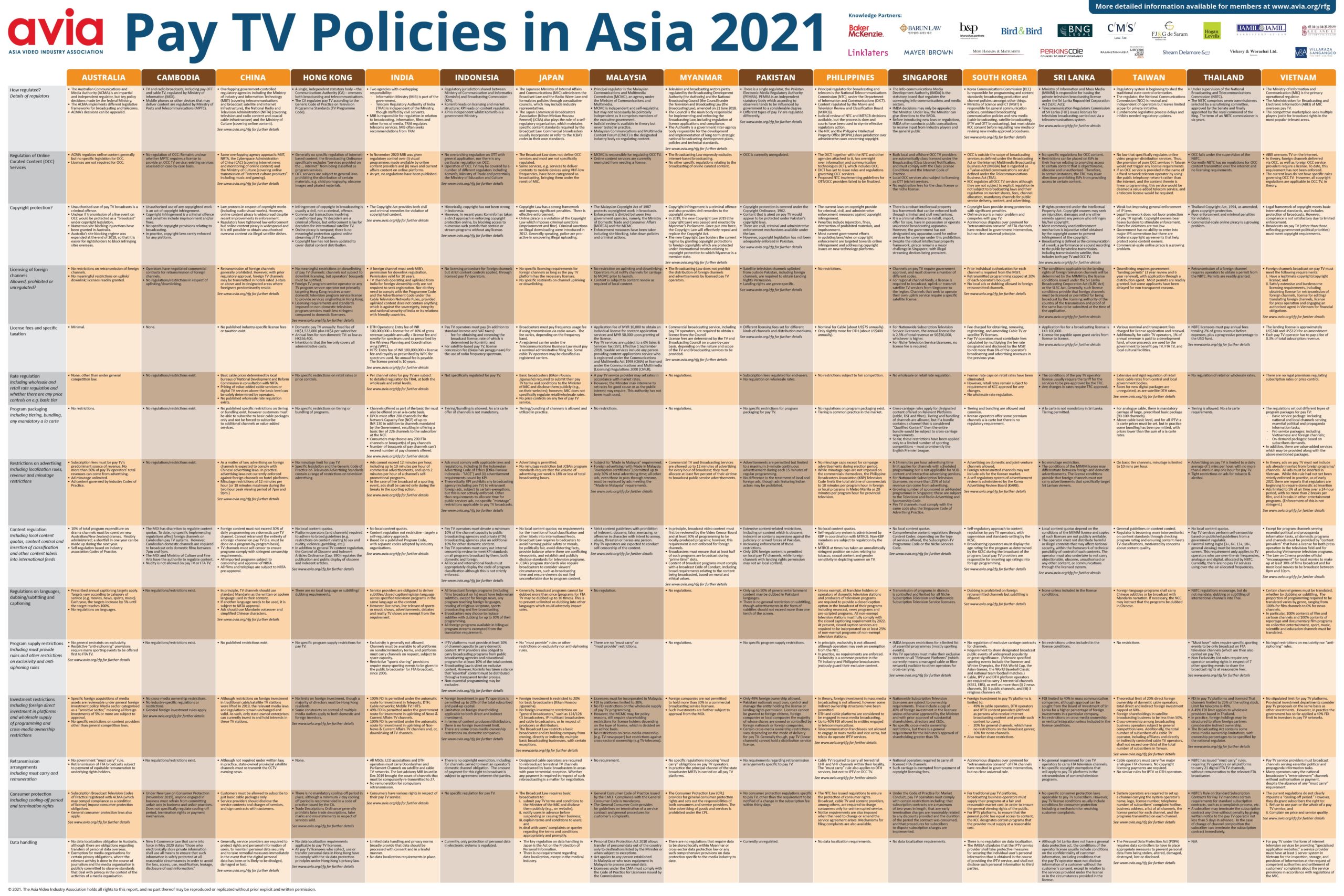

LB: The role of AVIA is to make the foundations of our industry as strong as possible, on behalf of the whole ecosystem. To that end we want to ensure that governments and regulators understand our industry, and we have a healthy two-way relationship with them so that they take the right Policy measures to support us and nurture its growth. Equally, the scourge of our industry today is Piracy, and we are the only regional organisation focused on cleaning up the mess. So if we can get those two things right, then we all stand on solid ground and we can then focus on the third pillar which is Insight, where we discuss the evolving business models of our industry and bring members together around a whole host of specific issues and challenges, through our committees and at our conferences.

Q2. AVIA has been conducting extensive research across different markets in Asia. What are the conclusions? How do you assess the growth of the market in 2019?

LB: We are not a data house so we don’t measure these thing empirically, but what is clear is that from the point of view of consumption, the industry is growing in leaps and bounds, and there genuinely never has been a better time to be a consumer. There is more being invested in local content creation in almost all markets, and similarly there is more being invested in content that is more regional in nature, Hollywood, Bollywood, Korean and increasingly Chinese. But behind this content curtain things are less pretty. Industry is clearly consolidating, so that means less players and more job losses. And with the rise of streaming, fewer players are aggregating more content. Streaming is a very different business proposition to the linear channel one, and we are going through the teething pains of adapting to this new world.

Q3. What has been the impact of Covid 19 pandemic on the Pay TV, OTT, Linear TV and Cable & Satellite markets across Asia? How soon will the markets be able to recover from this situation?

LB: How soon will they recover is anyone’s guess and the last thing we can express authority on is the future of this pandemic. But put it this way, we are working on a business planning case that it will be here for all of 2021. I desperately hope that is overly cautious, but I believe that if we plan for that scenario, then we will be in good stead for next year and then when things improve, you treat it as upside. I believe many parts of our industry are adopting that approach. As things stand, 2021 is set to be a much harder year than 2020. In terms of its effect to date, the biggest one has been a huge surge in video consumption. Never has our industry been more important and more relied upon. From entertainment to news. For some that has led to an uptick in subscriptions, but that has been countered by big pullbacks in advertising which has hurt. The relevance of linear television and its delivery methods of cable and satellite have been underscored. We are an industry in transition, but TV is not going anywhere, and no one delivering via cable or satellite had to worry about reducing HD signals to SD to counter bandwidth issues.

Q4. What is your assessment of the growth of the OTT, Cable and Satellite & Pay TV markets in India?

LB: In the short to medium term, growth in any sector, including those in India, would be minimal. The media and entertainment (M&E) sector would not prove to be an exception; especially with intrusive regulation stifling growth even before the COVID pandemic struck the Indian M&E segment hard. The E&Y-FICCI Frames entertainment report, released earlier this year, pegged the Indian M&E industry to be worth INR 1.82 trillion/ approx USD 25.7 billion, out of which the TV industry’s share was estimated to be INR 788 billion as of 2019. We don’t think that these numbers would grow much in 2020 or even mid-way 2021. Though AVIA is not in the business of crystal ball gazing, but the feedback from the industry and our member-companies in India is that slowing economy, continuing regulatory over-reach and the COVID pandemic (in that order) would impede growth in a major way, if not pushed into a negative phase. An indication to the slowing down is the closure announcement related to some linear TV channels. More TV channels could shutter as we move forward, mostly owing to over-regulation hampering business plans of big and small TV channels. The India OTT space is estimated to be worth approximately USD 1.2 billion with about 30 streaming platforms, including global players. This also highlights that if a sector is left alone by policy-makers, it can blossom as the Indian digital space has done, highlighting variety, content and business innovations, and offering multiple choices to consumers. Yes, streaming platforms have gained during the pandemic period — and would

continue to do so — but trying to have legacy regulatory framework for a new tech is fraught with dangers of killing the goose.

Q5. Piracy is a major issue confronting all the markets. What kind of initiatives does AVIA undertake to curb the growth of piracy?

LB: There are a number of effective and proven strategies that AVIA has put in place to disrupt and curb such egregious piracy levels. Firstly an effective site blocking process that blocks access to illegal streaming websites and ISD application servers. Site blocking has been a key feature of AVIA’s anti-piracy strategy working alongside governments to introduce a regulatory site blocking protocol or make current blocking processes more streamlined and effective. In Indonesia, for example, we have referred over 2,400 piracy websites and application domains that have been blocked over the past 12 months (August 2019 – August 2020) averaging 60 sites blocked every 10 days. The results of this strategy have been impressive with Indonesia fast becoming a market leader in video IP protection in South East Asia, boosting the growth of local and international legitimate services. Piracy traffic has dropped 68% and traffic to legitimate video sites increasing by 18% within the same period. In June 2020, an Indonesian YouGov consumer study found a massive 55% reduction in consumers accessing piracy websites over the past ten months, with 28% of online consumers admitting to accessing piracy websites compared to 63% from a similar survey conducted in September 2019. Enforcement remains key and we continue to work alongside our members in investigating and referring major crime groups for criminal enforcement. In Thailand, for example, working alongside TrueVisions we were instrumental in taking down a major IPTV syndicate, which according to the Thai government had caused more than USD$122 million in damages copyright owners, and that over the past 2-3 years, the syndicates had made an estimated USD$9 million in illicit revenue. There is no one silver bullet to disrupting and reducing online piracy. Collaboration is key and what is required is a network to fight these criminal networks. AVIA works alongside our stakeholders as well as alongside technology platforms, payment processors, e-market platforms and other intermediaries. Disrupting the technological ecosystem of the piracy websites as well as the illicit commercial transactions at the point of sale is another key component of our anti-piracy strategy.

Q6. There are various market-wide issues impacting the markets and those include Privacy, regulatory

challenges and the impact of 5G on the digital divide. How does AVIA address the challenges and opportunities in different countries as each country poses a different set of problems with its unique culture and market situation?

LB: Indeed, every jurisdiction is different and the nature of the problems posed varies depending on regulatory history, political framework and market structures. There are, however, some common themes:

a) Every government has legacy broadcasting/cable/satellite/content regulations which needs to be seriously reviewed, and pared down. The many barnacles which have grown on structures put in place in the 1950s and 60s need to be scraped off, if the industry is to produce the economic gains that are possible. And unfortunately, every regulator is loath to do what is necessary, because the easier task is just to cruise along without making fundamental changes.

b) The biggest common change in the environment has been the development of online TV, delivered over the internet. Because this mode of delivery crosses national borders and directly enters consumer homes in a way that no other TV system has done, it poses new challenges for all governments, who like to indulge the conceit that they can efficiently monitor and control what their citizens watch – and still enjoy the benefits of technological advancement and media development.

c) Apart from the growing internationalization of content supply, a shared benefit of technology development has been the massive and continuing improvement in the capacity of delivery systems. Ongoing investment in fibre-based networks, as well as future rollout of commercial 5G services, are producing a major improvement in bandwidth available to consumers, and – not surprisingly – the major use to which consumers put this bandwidth is watching more and better quality video.

So, there is no shortage of common challenges, even as each jurisdiction’s unique conditions cause the

specific questions to be posed differently. AVIA can deal effectively with these myriad challenges because our member companies have extraordinary vision and commitment, so we have a large team of supremely-qualified experts, backed by multi-million dollar funding, which allows us to bring the best in international expertise to our dialogues with Asian governments.

Q7. What are the new set of initiatives that AVIA is planning in the Covid times?

LB: The principles of regulatory engagement and fighting piracy do not change. What changes is the way we interact and the way we bring industry together. We are living in a virtual world, holding zoom meetings and virtual conferences. It is not a disaster, it works and we are all adapting, but equally we know that nothing can replace a physical meeting and as social animals, we can achieve more and do more when we get back to a world that allows travel and physical engagements. So we are making the most of the situation now, and actually enjoying it, and finding lots of positives. But equally we look forward to the day when, as I believe will definitely happen, we can get back to a new normal.

Categorised in: AVIA News, Industry News

This post was written by AVIA PR