| 10:20 |

The Future of Television – The New Business Models of Today

While television still dominates the media landscape in Vietnam, mobile internet is taking over as the primary way to access content in the region. The TV industry in Vietnam is now faced with the mammoth task of adapting to this new reality, with new market entrants and different partnership models. What are the challenges and opportunities in today’s TV market? How important will digital become compared to linear, and how do both sectors grow?

Panelists:

Nguyen Quang Dong, Director, Institute for Policy Research and Communication Development (IPS)

Nguyen Hanh, President, Q.net

John Huddle, Director, Market Development, Asia, SES

Alexandre Muller, MD APAC, TV5MONDE

With Louis Boswell, CEO, AVIA

|

|

| 10:50 |

How are Pay TV Platforms Reinventing Themselves in this Age of Transformation?

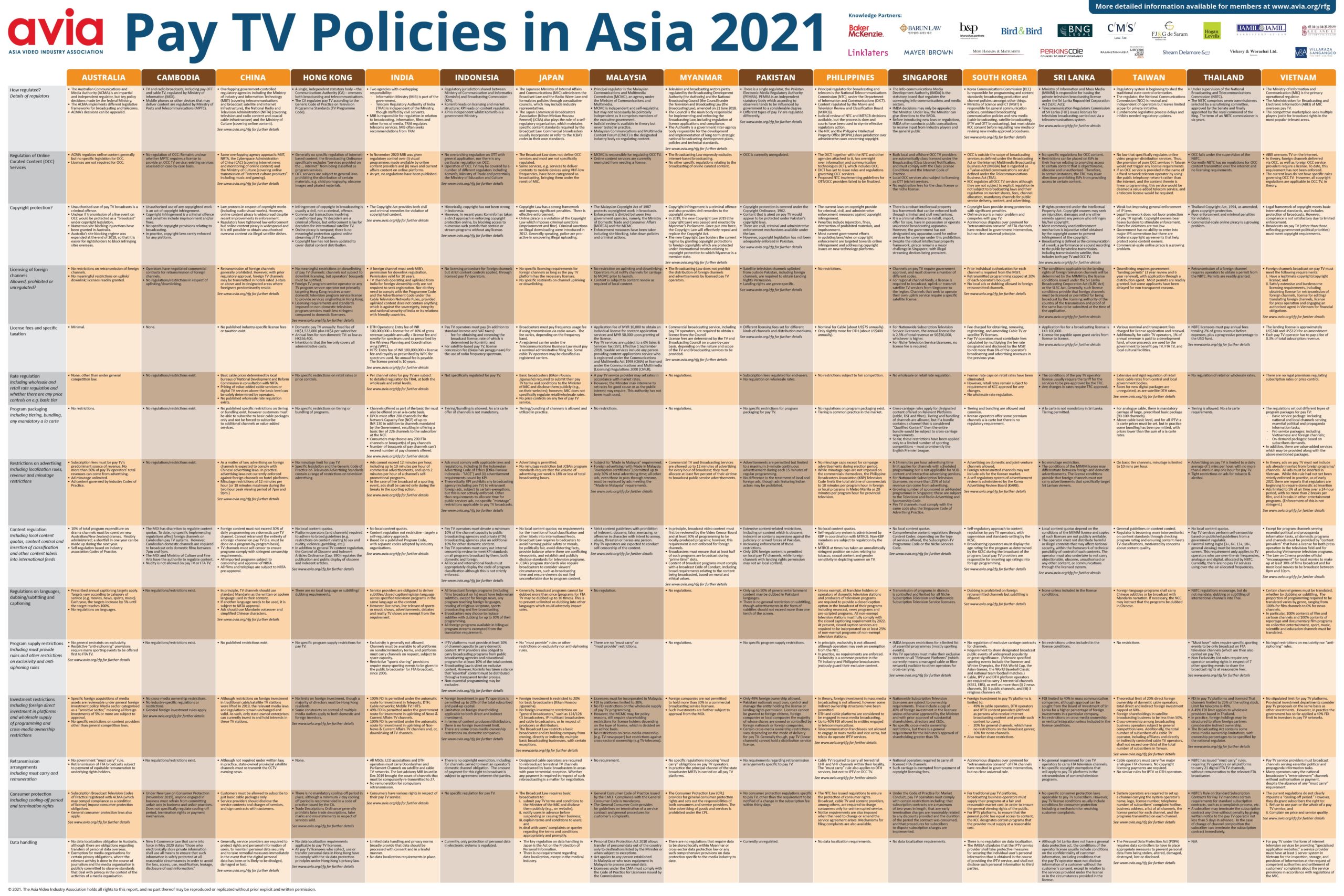

With the domestic market becoming much more active due to the arrival of online video streaming services, Pay TV platforms are now bracing themselves for a challenge. Telecoms analysts GlobalData estimates that household penetration of Pay TV subscriptions in Vietnam will decline from 35.4% in 2020 to 30.3% by 2024. How do Pay TV platforms perceive the situation and what does the future hold for their legacy business? How do they reinvent

themselves to set their business apart from the competition and overcome the challenges they are facing?

Panelists:

Stéphane Le Dreau, SVP, Regional General Manager APAC, NAGRA

Vu Tu Thanh, Consultant, AVIA, Deputy Regional Managing Director & Representative, US-ASEAN Business Council

Phạm Thanh Phuong, Vice Director of Value-Added Services Center, Viettel Telecom

With Tran Thi Thanh Mai, General Director, Kantar Media Vietnam

|

|

| 11:20 |

VOD Streaming – How is it Upending the Market?

The market shares of cable and satellite networks have been shrinking gradually in the past few years in Vietnam, making way for the rapid growth of VOD streaming services. According to Akamai’s Asia Pacific Media Industry Report, Vietnam’s VOD industry is estimated to be at US$105 million in revenue for 2020 and its annual growth rate is expected to be 9.4%. What are the investment opportunities, how do you stay competitive in this market and how

can you drive higher ARPUs?

Panelists:

Ngo Thi Bich Hanh, SVP, BHD – Vietnam Media Corp

Greg Armshaw, Head of Media Asia, Brightcove

Harini Gopalakrishnan, CFO, Galaxy Play

Ian McKee, CEO, Vuulr

With Celeste Campbell-Pitt, Chief Policy Officer, AVIA

|

|

| 11:50 |

Taking the Consumer Experience on Video Streaming to the Next Level

Every video-streaming player wants us to believe that the only essential ingredient for binge-watching is great content. Amidst aggressive content marketing, technology is what underpins a sublime consumer experience. We look at the different types of technology that can enhance consumer experience and create a perceived value for content. How can an organisation view technology as an investment today that can improve business profitability in the long run and how is its ROI being measured?

Panelists:

Hrishikesh Varma, Director Product Management, Akamai Technologies

Ashim Mathur, Senior Regional Director, Emerging Markets, Dolby Laboratories

Dokyung Lee, VP Sales APAC, Viaccess-Orca

With James Miner, CEO, MinerLabs & Video Assure

|

|

| 13:30 |

How Content Providers Could Connect to Online Audiences Successfully and Uncover New Revenue Streams

Attracting today’s viewer is no longer just about the content. Content providers need a holistic distribution strategy which considers various platforms, timing, formats and devices. Understanding the role and strengths of each distribution platform is essential, but fragmented viewership can make it difficult to measure success. This session will help the audience understand YouTube’s unique strengths and provide examples of how Vietnamese

broadcasters have been leveraging YouTube to reach new audiences and uncover new revenue streams.

Mukpim Anantachai, Head of Partnerships, Vietnam & Thailand, YouTube

|

|

| 13:45 |

The Rise of AVOD in Vietnam

The AVOD business represents a fast-growing opportunity in the Vietnam market but also presents challenges in getting its content discovered by viewers. According to Statista market forecast, VOD sales in Vietnam is predicted to reach US$141 million by 2024, with SVOD making up the lion’s share, estimated to have generated US$71m in 2019 and predicted to account for US$120m by 2025. What lies ahead for Vietnam OTT advertising as consumption soars and device adoption evolves? How receptive are the Vietnamese consumers to advertising on OTT and what are their preferences? How can broadcasters/content owners open up their inventory to maximise ad revenue?

15min presentation by Anthony Tsang, Director of Business Development, Magnite followed by a panel discussion.

Panelists:

Andrew Niblett, Chief Investment Officer, GroupM Vietnam

Anthony Tsang, Director of Business Development, Magnite

John Xavier, VP of Brand & Ads Solutions, POPS Worldwide

Giang Nguyen, Lead Director, Inventory Partnerships, SEA, The Trade Desk

With Greg Armshaw, Head of Media Asia, Brightcove

|

|

| 14:30 |

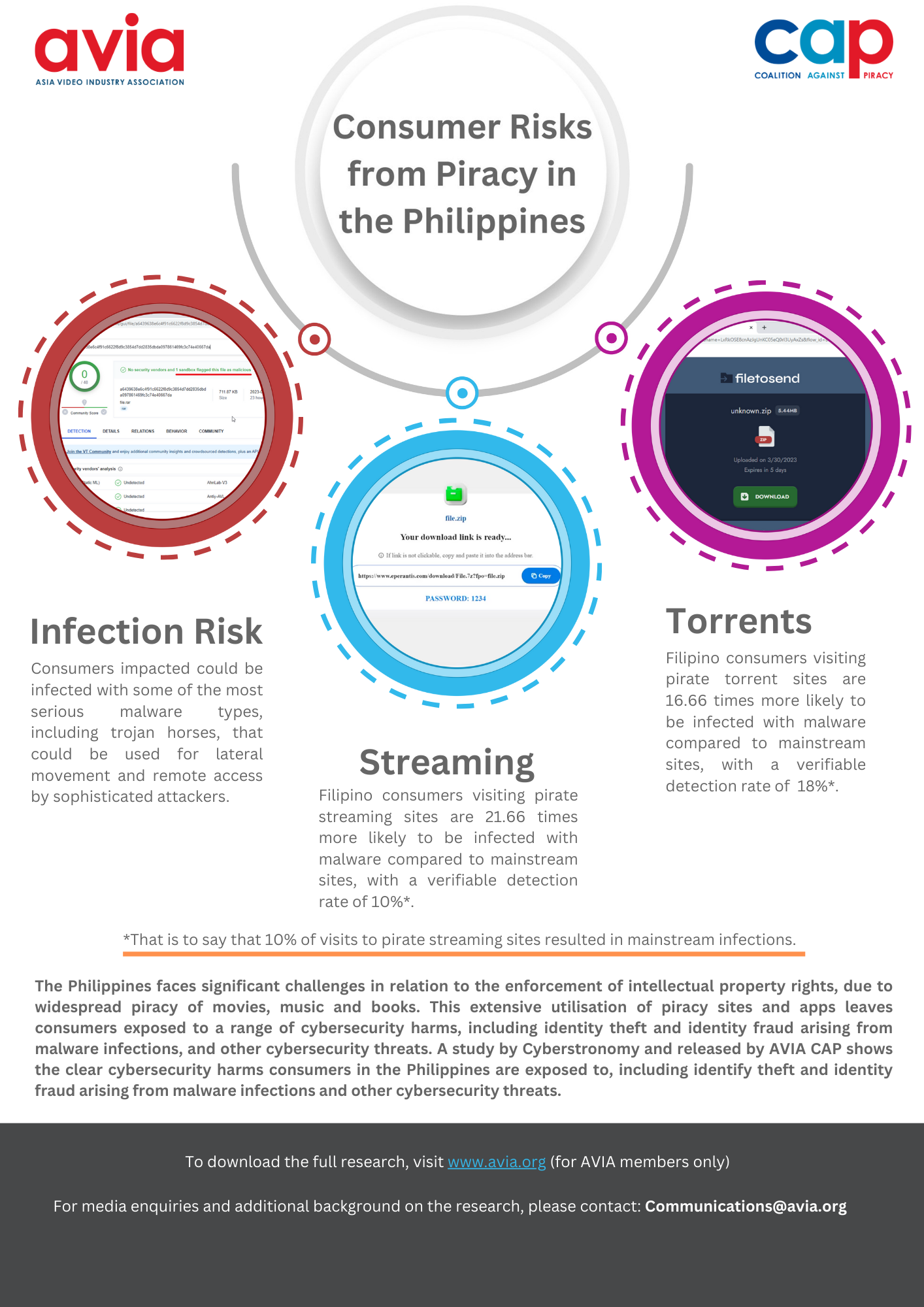

The Pernicious Problems of Piracy

Paid streaming services have been thriving in Vietnam, with global names such as Netflix and HBO GO gaining a strong foothold in the market and local streaming platforms such as Fim+ and FPT Play rising at a swift rate. Meanwhile, online piracy remains prevalent and presents a major obstacle for companies in this segment to fully optimise their potential. We explore what some of the piracy enforcement measures are that have been implemented, what measures are currently being considered by government, and whether additional changes can

be made to reduce piracy and migrate Vietnamese consumers to legal services.

Panelists:

Ngo Thi Bich Hanh, SVP, BHD – Vietnam Media Corp

Mark Mulready, Vice President – Cyber Services, Irdeto

Phan Vu Tuan, Managing Partner, Phan Law Vietnam

Sean Godfrey, Senior Commercial Solicitor (APAC), The Premier League

With Aaron Herps, GM, AVIA Coalition Against Piracy (CAP)

|

|

| 15:00 |

Global or Local Content – What do Vietnamese Want?

Vietnam’s VOD streaming market has been growing rapidly, with the pandemic prompting more consumers to migrate to these services. This has sparked fierce competition between local and foreign players who are vying to raise their content competitiveness to win the hearts of local consumers. Which types of content on the VOD platforms are resonating with local viewers? How do changing consumer habits affect content strategies and in particular, how do you cater your offering to speak to younger audiences?

Nguyen Hanh, President, Q.net

With Celeste Campbell-Pitt, Chief Policy Officer, AVIA

|

|

| 15:20 |

Closing Remarks and End of Conference |

|